Description

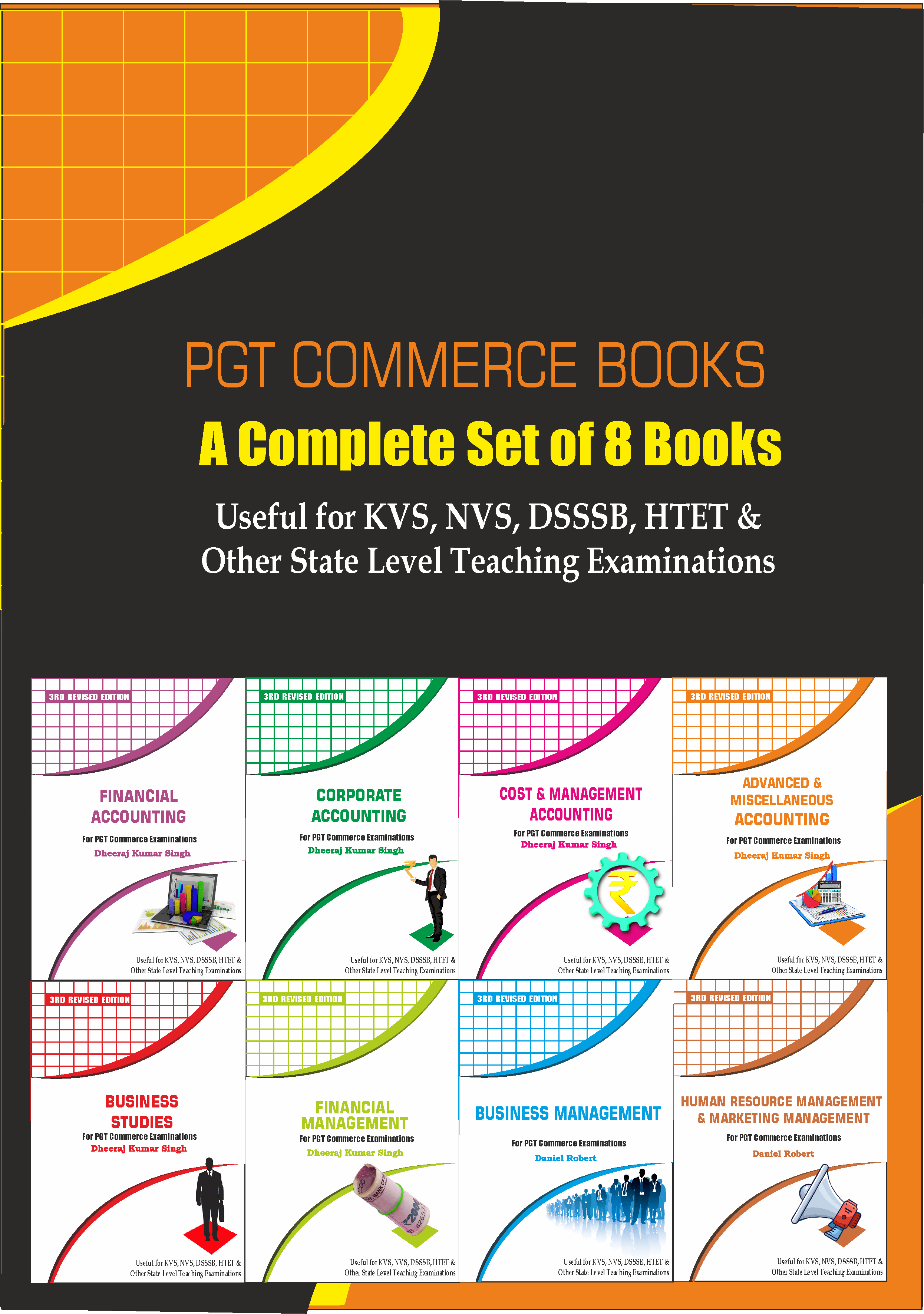

NVS PGT Commerce Books – Complete Set of 8 Books

List of E- Books | Printed Books for PGT Commerce

| Name of Book |

Author |

| Financial Accounting for PGT Commerce |

Dheeraj Kumar Singh |

| Corporate Accounting for PGT Commerce |

Dheeraj Kumar Singh |

| Cost & Management Accounting for PGT Commerce |

Dheeraj Kumar Singh |

| Advance & Miscellaneous Accounting for PGT Commerce |

Dheeraj Kumar Singh |

| Business Studies & International Business for PGT Commerce

Part 1 – Business Studies

Part II- International Business |

Dheeraj Kumar Singh |

| Financial Management for PGT Commerce |

Dheeraj Kumar Singh |

| Business Management for PGT Commerce |

Daniel Robert |

| Marketing Management & Human Resource Management for PGT Commerce |

Daniel Robert |

Financial Accounting Book – 1

Corporate Accounting Book – 2

Cost & Management Accounting Book – 3

Advance & Miscellaneous Accounting Book – 4

Business Studies Book – 5

Financial Management Book – 6

Business Management Book – 7

Human Resource Management & Marketing Management Book – 8

Syllabus - PGT Commerce NVS

NVS PGT Commerce Syllabus

UNIT- 1 : Business Studies

Introduction to Business– Concepts, characteristics, objectives. Classification of business as industry and commerce. Distinctive features of business – Business, profession and employment. Choice of Form of Organization. Large Scale and Small Scale Business- Assistance by Government to Small Scale Sector.

Form of Business Organization – Sole Proprietors, Joint Hindu Family, Partnership, Joint Stock Company and its formation, Cooperative organization.

Business ownership– Private, public and Joint sector. Public Enterprises, Role – dynamics of Public Sector, Global Enterprises (Multinational Companies), Joint Ventures.

Business Services – banking, insurance, transportation, warehousing, communication, Impact of Technology on Business Services.

Trade: Internal Trade Retail and Wholesale trade, Emerging modes of business franchisee, E-business and Outsourcing.

International Business–Export- Import – Procedure and documentation, EPZ/SEZ . International Trade Institutions and Agreements – WTO, UNCTAD, World-Bank, IMF.

Business Finance: Sources – owners and borrowed fund, Sources of raising finance, Equity and preference Shares, GDR, ADR, Debentures, Bonds – Retained Profit, Public Deposits, Loan from Financial Institutions and commercial banks, Credit-rating and rating agencies, Trade credit, Micro-credit.

Social Responsibility of Business & Business Ethics

Environment protection

UNIT- 2 : Management

Management – concept, objectives, nature of management as Science, Art and Profession, levels, Principles of Management general and scientific.

Business Environment – meaning, importance, dimensions, changing business environment–special reference to liberalization, privatization and globalization, Business – a Futuristic vision.

Management Function – Planning, organizing, staffing, directing, controlling and coordination

Business Finance: Financial Management – meaning, scope, role and objectives, financial planning, Capital structure, leverage, Fixed and working capital – meaning and factors affecting its requirements.

Financial Market – Money Market-nature, instruments, Capital Market- Primary and secondary, Stock exchange, NSEI, OTCEI, Procedures, SEBI.

Human Resource Management– meaning, importance, man-power estimation, Recruitment and selection, Training and development, Compensation, Performance Evaluation

Marketing – meaning, functions and role, Levels of Marketing, Changing facets of marketing, Product-mix, Models of Marketing.

Organizational Behaviors: Individual behaviors, Motivation–concepts and applications, Personality perception, Learning and attitude, Leadership and its approaches, Communication, Group dynamics.

Emerging Trends in Management – Business Process Reengineering, Total Quality Management, Quality Circles, Benchmarking, Strategic Management, Knowledge Management, Business Standardization and ISO.

Consumer Protection – Meaning, importance, consumers’ rights, Consumers’ responsibilities, Consumer awareness and Legal redressal with special reference to consumer Protection Act, Role of consumer organization and NGOs.

UNIT- 3: Financial Accounting

Accounting: Meaning, objectives, qualitative characteristics of Accounting information, Accounting Principles, Accounting concepts, Accounting standards, Cash and Accrual Basis of Accounting.

Process of Accounting: Voucher, Transaction, Accounting Equation, Rules of Debit and Credit, Book of original entry-Journal and Special Purpose Books, Ledger, posting from Journal and subsidiary books, Balancing of Accounts, Trial Balance and Rectification of Errors. Bank Reconciliation Statement.

Accounting for depreciation

Provisions and Reserves

Bills of Exchange

Non-Profit Organization

Partnership Firms – Reconstitution of Partnership (Admission, Retirement, Death and Dissolution),

Account of Incomplete Records

Consignment and

Joint ventures.

Accounting of Joint stock Companies: Share capital types of shares, accounting for issue, allotment forfeiture and re-issue of shares. Debentures –types, issue and method of redemption. Final Accounts of Sole proprietor and Joint Stock Companies. Emerging trends of presentation of Final Accounts.

Accounting for liquidation.

UNIT- 4: Financial Statement Analysis

Financial Statement Analysis: Meaning, significance, limitation. Tools for Financial Statement Analysis-comparative statements, common size statements, Trend analysis, accounting ratios.

Fund Flow Statement and Cash Flow Statement: Meaning, objectives, preparation as per revised standard issued by ICAI.

Cost Accounting- Nature, functions. Job costing, Process costing, Marginal costing, Cost-volume-profit relationship. Cost control and cost reduction techniques

Computers In Accounting: Introduction to Computers and Accounting Information System, Application of Computers in Accounting, Automation of Accounting process, designing accounting reports, MIS reporting, data exchange with other information system. Ready-made, customized and tailor made Accounting Systems.

Accounting And Database Management System –meaning, concept of entity and relationship in an accounting system, Data Base Management System (DBMS) in accounting.

Inflation accounting,

Accounting for Human Resource of an Organization and Social Responsibility