DU PhD in Financial Studies 2020

- Two numbers differ by 5. If their product is 336, the sum of the two numbers is

1. 27

2. 38

3. 37

4. 41 - The perimeter of a rhombus is 40 cm. If the length of one of its diagonals be 12 cm, the length of the other diagonal is

1. 14cm

2. 15cm

3. 16cm

4. 12cm - In an alloy, the ratio of copper and zinc is 8:3. If 3.44 kg zinc is mixed in 16.72 kg of alloy, then the ratio of copper and zinc in the new alloy will be

1. 38:25

2. 21:25

3. 25:38

4. 25:27 - The diameters of two ends of a bucket are 20 cm and 10 cm and its height is 24 cm. The volume (in cc) of the bucket is

1. 4000

2. 4400

3. 4800

4. 1200 - The average age of 3 students is 15 years and their ages are in proportion 2:3:4. The age of the eldest student is

1. 15 years

2. 20 years

3. 24 years

4. 18 years - If 8 men can reap 80 hectares in 24 days, then how many hectares can 36 men reap in 30 days

1. 400

2. 450

3. 500

4. 550 - If in an experiment A and B are two events, then occurrence of event A or B simultaneously is represented by

1. A intersection B

2. A + B

3. A ‐ B

4. A union B - Which of the following is true from the equation: , where is the mean of the sample?

1. The sum of the deviations above the mean is the same as the sum of the deviations below the mean

2. Half the data lie above the mean of the values

3. The specific set of values does not have any outliers affecting the mean

4. Half the data lie below the mean of the values - Using Chebyshev’s theorem for standard deviation, calculate the percentage of data that lie within five standard deviations of the mean.

1. 89%

2. 75%

3. 96%

4. None of these - A probability density function:

1. Is the probability distribution of discrete outcomes.

2. Suggests that the probability that a random variable assumes a specific value must be positive.

3. Characterizes outcomes of a continuous random variable.

4. Can yield negative values depending on the values of the random variable, X. - If the covariance between stock A and stock B is 100, the standard deviation of stock A is 10% and that of stock B is 20%, calculate the correlation coefficient between the two securities.

1. ‐0.5

2. +1.0

3. +0.5

4. 0.0 - ________ is based on dividing a population into subgroups, sampling a set of subgroups, and conducting a complete census within the subgroups sampled.

1. Cluster sampling

2. Continuous process sampling

3. Judgment sampling

4. Systematic sampling - ________ are statistical errors that are due to the sample not representing the target population adequately.

1. Parallax errors

2. Computation errors

3. Quantization errors

4. None of these - Which of the following is implied from the standard error of the mean formula?

1. That true means of populations can be found easier than those of samples

2. That standard deviation increases with increase in sample size

3. That larger sample sizes provide greater accuracy in estimating the true population mean

4. That the true mean of the population can only be calculated using smaller sample sizes - Type II error occurs when the test:

1. Correctly fails to reject an actually true null hypothesis.

2. Incorrectly fails to reject an actually false null hypothesis.

3. Correctly rejects an actually false null hypothesis.

4. Incorrectly rejects an actually true null hypothesis. - Level of significance is the probability of:

1. Incorrectly rejecting an actually true null hypothesis.

2. Correctly failing to reject an actually true null hypothesis.

3. Incorrectly failing to reject an actually false null hypothesis.

4. Correctly rejecting an actually false null hypothesis. - The coefficients of dummy variables in a regression equation are known as ____(i)_____for the reason that they indicate by how much the value of the category that receives the value of 1 differs from the intercept coefficient of the _____(ii)_____.

1. (i) Differential slope coefficients & (ii) Debase category

2. (i) Differential intercept coefficients & (ii) Benchmark category

3. (i) Intercept Coefficients & (ii) Dependent Variable

4. None of these - If the computed p value of the JB statistic in an application is sufficiently low, we can ___________the hypothesis that the residuals are normally distributed

1. Accept

2. Neither reject nor accept

3. Reject

4. None of these - The regression model suffers from severe___________

1. Heteroscedasticity

2. Autocorrelation

3. Homescedasticity

4. Multicollinearity - How many members are there in Monetary Policy Committee (MPC) constituted by the Central Government under section 45 ZB of the Reserve Bank of India Act, 1934

1. 3

2. 5

3. 7

4. None of these - Which of the following represents the fiscal deficit target as percentage of GDP for FY 2020‐21in Union Budget

1. 3.8%

2. 3.3%

3. 3.5%

4. None of these - What is the current level of Cash Reserve Ratio (CRR) set by Reserve Bank of India

1. 5%

2. 4.5%

3. 3%

4. None of these - Who is the new President of the European Central Bank

1. Mario Draghi

2. Mark Carney

3. Andrew Bailey

4. Christine Lagarde - Which of the following events would make it more likely that a company would choose to call its outstanding callable bonds?

1. The company’s bonds are downgraded

2. Market interest rates rise sharply

3. Market interest rates decline sharply

4. The company’s financial situation deteriorates significantly. - Based on Capital Asset pricing Model (CAPM), calculate the cost of equity for Hexagon company. Risk free rate in the economy can be assumed as 6.5%, Market return is 11% and beta for Hexagon is 1.3.

1. 11.5%

2. 20.80%

3. 13.35%

4. None of these - AB Bearings Company has fixed operating costs of INR 50,000, variable costs of INR 4 per unit produced, and its products sell for INR 8 per unit. What is the company’s breakeven point, i.e., at what unit sales volume would income equal costs?

1. 15,000

2. 12,500

3. 10,000

4. None of these - To hedge a bond portfolio against an increase in interest rates, which of the following option position would be the best choice to hedge the downside risk while leaving as much of the upside potential impact

1. Long Call

2. Collar

3. Long Put

4. None of these - Saket has a portfolio worth INR 200 million, INR 50 million of which is his own funds whereas INR 150 million is borrowed funds. If the return on invested funds is 8% and cost of borrowed funds is 6%, calculate the return on the portfolio

1. 16%

2. 13%

3. 14%

4. None of these - Which of the following statements about Monte Carlo simulation is least accurate?

1. It is useful for estimating a project’s standalone risk

2. It uses best and worst case scenarios to determine most likely scenario

3. It is capable of using probability distributions for variables as input data

4. It produces both an expected value and a measure of variability of that value - If the cost of equity is 15%, earnings per share is INR 100, the dividend payout ratio is 50% and return on equity is 10%, the price of share according to Gordon model is

1. 400

2. 635

3. 525

4. None of these - Which of the following is not a money market instrument?

1. Treasury Bill

2. Certificate of Deposit

3. Commercial paper

4. Treasury Bond - The slope of the security market line (SML) equals

1. Stock Standard Deviation

2. Market Return

3. Stock Beta

4. None of these - The holding period return on a share of stock is equal to

1. The capital gain yield during the period, plus the inflation rate

2. The capital gain yield during the period, plus the dividend yield

3. The current yield, plus the dividend yield

4. None of these - Company Cera Ltd. Profit before tax (PBT) is INR 400 million, Tax Rate is 25%, Share capital is INR 200 million and Reserves and Surplus is INR 1,300 million. Calculate the Cera Ltd. Return on equity (ROE)

1. 33%

2. 15%

3. 20%

4. None of these - If a company’s return on equity (ROE) is 15%, Net Profit margins are 25% and equity multiplier is 1.2, calculate the Asset Turnover ratio according to Du Pont analysis.

1. 0.3

2. 0.4

3. 0.6

4. None of these - Bharat’s equity Portfolio return and standard deviation is 12% and 20% respectively. If the risk‐free rate is 6%, beta of portfolio is 0.9 and equity risk premium is 5%, calculate the Jensen’s Alpha for portfolio.

1. 1.1%

2. 1.8%

3. 1.3%

4. None of these - Which of the following statements is most accurate?

1. Conglomerate mergers combine firms in similar industries

2. Horizontal mergers combine firms in similar industries

3. Vertical mergers are always for moving up the supply chain towards the ultimate consumer

4. None of these is accurate - If a portfolio had a return of 50%, the risk‐free asset return was 6%, and the standard deviation of the portfolio’s returns was 25%, the coefficient of variation (CV) would be

1. 1.76

2. 2.0

3. 0.5

4. None of these - Maxwell Publishing follows a strict residual dividend policy. All else equal, which of the following factors would be most likely to lead to an increase in the firm’s dividend per share?

1. The company increases the percentage of equity in its target capital structure

2. The firm’s net income increases

3. Earnings are unchanged, but the firm issues new shares of common stock.

4. The number of profitable potential projects increases - Kenwood Products Ltd. recently completed a 5‐for‐1 stock split. Prior to the split, its stock sold for INR 500 per share. If the firm’s total market value increased by 10% as a result of increased liquidity caused by the split, what was the stock price following the split?

1. 100

2. 91.67

3. 110

4. None of these - Which of the following statements is Correct?

1. Semi‐strong‐form market efficiency implies that as soon as any public or private information comes into being it is incorporated into stock prices

2. Weak‐form market efficiency implies that recent trends in stock prices are of no use in predicting future stock prices.

3. Market efficiency implies that all stocks should have the same expected return.

4. According to strong‐form market efficiency, insiders would find it possible to consistently earn abnormal returns in the stock market even if they have superior knowledge about the company. - As the number of stocks in a portfolio is increased

1. Unique risk decreases and approaches zero

2. Market risk decreases

3. Unique risk decreases and becomes equal to market risk

4. Total risk approaches zero - A project will have only one internal rate of return if:

1. The net present value is positive

2. The net present value is negative

3. The cash flows decline over the life of the project

4. There is a one‐sign change in the cash flows - If an investment project (normal project) has an IRR (Internal rate of Return) equal to the cost of capital, the NPV (net Present value) for that project is

1. Positive

2. Negative

3. Zero

4. Unable to determine

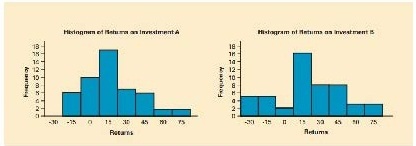

Suppose that you are facing an investment decision problem about where to invest your savings that remains after you have deducted the anticipated expenses for the next year. One of your friends has suggested two types of investment (A & B), and to help make the decision you acquired some rates of return from each type of investments and the collected returns for the two types of investments are presented in the histograms. Carefully examine the histograms and respond to the following questions

- Returns from both the investment options (A & B) are ____________ skewed.

1. Negatively

2. Asymmetrically

3. Symmetrically

4. Positively - The spread of returns for investment A is _____________ that for investment B.

1. Considerably less than

2. More than

3. Similar to

4. Collinear - Assuming that investors dislike large spread in returns, investment A is _____________ than B

1. Inferior

2. Underperformer

3. Low yielding

4. Superior

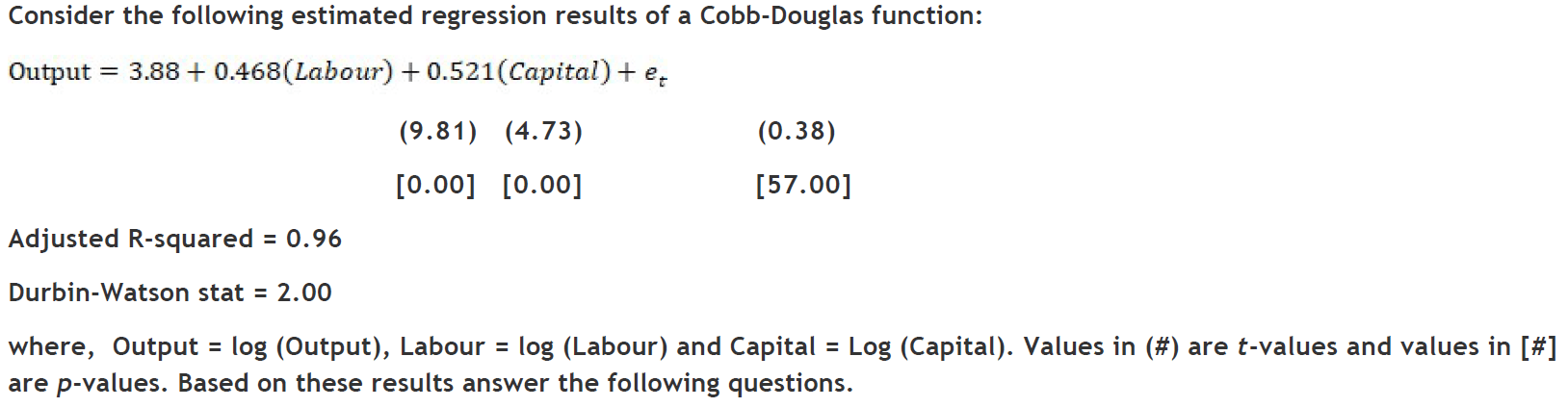

- If we increase the labor input by 1%, on average, output goes up by about ____________, holding the capital inputconstant

1. 47%

2. 4.68%

3. 0.47%

4. Output will not change at all - The impact of change in capital input is statistically _____________ on output

1. Insignificant

2. Highly significant

3. Neutral

4. None of these - The computed value of Adjusted R‐squared clearly indicate towards a _________ model

1. Badly fit

2. Inadequately fit

3. Best fit

4. None of these

Answer Key

1 (3) 2 (3) 3 (1) 4 (2) 5 (2) 6 (2) 7 (1) 8 (1) 9 (3) 10 (3) 11 (1) 12 (1) 13 (4) 14 (3) 15 (2) 16 (1) 17 (4) 18 (3) 19 (*) 20 (4) 21 (3) 22 (3) 23 (4) 24 (3) 25 (4) 26 (2) 27 (3) 28 (3) 29 (2) 30 (3) 31 (4) 32 (3) 33 (2) 34 (3) 35 (4) 36 (4) 37 (2) 38 (3) 39 (2) 40 (3) 41 (2) 42 (1) 43 (4) 44 (3) 45 (4) 46 (1) 47 (4) 48 (3) 49 (1) 50 (3)