M.Com Entrance – Delhi University Previous Year Question Paper (Subject wise)

Index

| Unit | Subjects | Page No. |

| 1 | Financial Accounting | 5-19 |

| 2 | Corporate Accounting | 20-30 |

| 3 | Cost & Management Accounting | 31-52 |

| 4 | Business Mathematics | 53-71 |

| 5 | Business Statistics | 72-94 |

| 6 | Macro Economics & Indian Economy | 95-117 |

| 7 | Micro Economics | 118-137 |

| 8 | Income Tax | 138-150 |

| 9 | Business Law | 151-162 |

| 10 | Business Management | 163-175 |

| 11 | Corporate Law | 176-185 |

M.Com Entrance Scanner – Previous Year Question Paper

Delhi University “From 2011 to 2020”

| Units | Subjects | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Unit 1

|

Financial Accounting | 12 | 16 | 16 | 15 | 12 | 10 | 6 | 6 | 4 | 7 |

| Corporate Accounting | 8 | 3 | 6 | 6 | 9 | 6 | 11 | 7 | 8 | 5 | |

| Cost & Management Accounting | 20 | 21 | 18 | 19 | 19 | 10 | 8 | 12 | 13 | 13 | |

| Unit 2 | Business Mathematics | 20 | 20 | 20 | 20 | 20 | 13 | 12 | 12 | 12 | 13 |

| Business Statistics | 20 | 20 | 20 | 20 | 20 | 13 | 13 | 13 | 13 | 12 | |

| Unit 3 | Macro Economics & Indian Economy | 31 | 20 | 20 | 20 | 35 | 13 | 12 | 13 | 12 | 13 |

| Micro Economics | 9 | 20 | 20 | 20 | 15 | 13 | 8 | 14 | 13 | 12 | |

| Unit 4

|

Income Tax | 10 | 10 | 9 | 5 | 3 | 5 | 5 | 10 | 10 | 6 |

| Business Law | 3 | 5 | 8 | 10 | 19 | 6 | 9 | 4 | 4 | 7 | |

| Business Management | 15 | 10 | 15 | 15 | 7 | 10 | 10 | 7 | 10 | 8 | |

| Corporate Law | 12 | 15 | 8 | 10 | 11 | 5 | 1 | 2 | 1 | 4 | |

| Total Questions without GK | 160 | 160 | 160 | 160 | 160 | 104 | 95 | 100 | 100 | 100 | |

| GK | 40 | 40 | 40 | 40 | 40 | 26 | 5 | – | – | – | |

| Total Questions | 200 | 200 | 200 | 200 | 200 | 130 | 100 | 100 | 100 | 100 |

Financial Accounting Delhi University – Question Pattern

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| 11 | 16 | 16 | 15 | 12 | 10 | 6 | 6 | 4 | 7 |

2020 (7 Questions)

- In case of rising prices (inflation), FIFO method will:

(a) Provide lowest value of closing stock and profit

(b) Provide highest value of closing stock and profit

(c) Provide highest value of closing stock but lowest value of profit

(d) Provide highest value of profit but lowest value of closing stock - Which of the following will cause difference on a trial balance

(a) An invoice omitted from the sale day book

(b) An invoice of Rs.1,500 entered in the sale day book as Rs.15,000

(c) An invoice of Rs.5,000 entered in the sale day book not included in the monthly total

(d) A credit note entered to the sales day book - International Accounting Standards (IAS) have been developed by:‐

(a) The European commission

(b) The International accounting standard committee

(c) The financial reporting council

(d) All of these - Which one of the following item cannot be recorded in the appropriation account in case of partnership accounting

(a) Interest on capital

(b) Interest on drawings

(c) Rent paid to partners

(d) Partners salary - In the absence of partnership deed, interest on partners loan is payable by firm @

(a) 12% p.a

(b) 6% p.a

(c) 10% p.a

(d) 16% p.a - Royalties revenue should be recognized

(a) On an accrual basis in accordance with the terms of the relevant agreement

(b) On cash basis

(c) On an actual basis

(d) Revenue is recognized on the time proportion basis - AS‐29 is Applicable only to

(a) Provision for valuation adjustment for fixed Assets

(b) Provision for Liabilities and charges

(c) Provision for valuation adjustment for current assets

(d) Furniture

2019 (4 Questions)

- When a fixed Asset is obtained as a gift, the account to be credited is

(a) Capital Reserve A/c

(b) Goodwill A/c

(c) General Reserve A/c

(d) Donor’s A/c - Provision for bad debt is made as per the

(a) Going Concern Concept

(b) Entity Concept

(c) Conservatism Concept

(d) Cost Concept - Which of the following statements is false ?

(a) Debit balance of bank column of Cash Book is an Asset

(b) Credit side total of Discount column of Cash Book is an income

(c) Credit balance of Bank Pass book is an overdraft

(d) Debt balance of Cash column of Cash Book is an Asset - A fixed asset originally acquired for Rs. 20, 000 is replaced by a new asset costing Rs. 50,000. But the estimated cost of replacement of the original asset is Rs. 30,000. Hence, the capital charge equals

(a) Rs. 50,000.

(b) Rs. 20,000.

(c) Rs. 30,000.

(d) Rs. 40,000.

2018 (6 Questions)

- Which of the following are not true for a bank reconciliation statement

(i) Part of double entry system

(ii) Not Part of double entry system

(iii) Sent by the firm to the bank

(iv) Posted to the ledger account

(a) (ii) (iii) and (iv)

(b) (i) and (ii)

(c) (i) (iii) and (iv)

(d) (i) (ii) and (iv) - The outflow of funds to acquire an asset that will benefit the business for more than one accounting period is referred to as

(a) Capital Expenditure

(b) Deferred Revenue Expenditure

(c) Miscellaneous Expenditure

(d) Revenue Expenditure - If an accumulated provision for depreciation account is in use then the entries for the year’s depreciation would be

(a) Debit Assets Account, Credit Profit and Loss Account

(b) None of these

(c) Credit Provision for depreciation account, Debit Profit and loss Account

(d) Credit Assets Account, Debit Provision for depreciation account - In case of rising prices (inflation), FIFO method will :

(a) Provide highest value of closing stock and profit

(b) Provide highest value of closing stock but lowest value of profit

(c) Provide highest value of profit but lowest value of closing stock

(d) Provide lowest value of closing stock and profit - AS- 6 is not applicable on

(a) All of these

(b) Goodwill

(c) Forests and plantations

(d) Live Stock - Who is the father of Accounting

(a) Al khawarizmy

(b) AL Mazendarany

(c) Fra luca Picioli

(d) Leonardo da vinci

2017 (6 Questions)

- Any change in the accounting policy relating to inventories which has an effect in the current or later period should be disclosed. This is accordance with the Accounting Principle:

(a) Going concern

(b) Conservation

(c) Consistency

(d) Materiality - X and Y shares profits and losses in the ratio of 4:3. They admit Z in the firm with 3/7 share which he gets 2/7 from X and 1/7 from Y. the new profit sharing ratio would be:

(a) 2:2:3

(b) 7:3:3

(c) 1:2:3

(d) 5:2:3 - A firm has Rs. 40,000 as its annual profits with the rate of normal profit as 10%. The assets of the firm are worth Rs. 2,80,000 and liabilities are worth Rs. 1,50,000. Calculate the value of goodwill by capitalization method.

(a) Rs.1,80,000

(b) Rs.2,70,000

(c) Rs.1,70,000

(d) None of these - Provision for bad and doubtful debts is created in anticipated of expected bad debts on the basis of:

(a) Conservatism principle

(b) Going concern principle

(c) Disclosure principle

(d) None of these - From the information given below, calculate the interest to be paid:

Cash price = Rs.2,00,000

Down payment = Rs.20,000

Balance to be paid in three equal installments of Rs.60,000 each plus interest @10%p.a.

(a) Rs.36,000

(b) Rs.18,000

(c) Rs.20,000

(d) None of these - The FIFO inventory costing method (when using a perpetual inventory system) assumes that the cost of the earliest units purchased is allocated in which of the following ways?

(a) First to be allocated to the ending inventory

(b) Last to be allocated to the cost of goods sold

(c) Last to be allocated to the ending inventory

(d) First to be allocated to the cost of goods sold

2016 (10 Questions)

- Accrual basis accounting:

(a) Results in higher income than cash basis accounting

(b) Leads to the reporting of more complete information than does cash basis

(c) Is not acceptable under GAAP

(d) Omits adjusting entries at the end of the period - Which of the following is not an account?

(a) Sales revenue

(b) Net sales

(c) Salaries

(d) Supplies expense - Accounting conventions include all of the following except:

(a) Periodicity

(b) Materiality

(c) Conservatism

(d) Cost-benefit - A capital reserve is built out of:

(a) Recurring profits

(b) Non-recurring profits

(c) Revenue

(d) Reserved fund - A and B share profits and losses in the ratio of 2 : 1. C has been admitted with 1/4th share in profits and losses. The new profit sharing ratio of the partners will be:

(a) 2 : 1 : 1

(b) 1 : 2 : 1

(c) 2 : 1 : 2

(d) None of the above - The value of goodwill, according to the simple profit method, is:

(a) The product of current year’s profits and number of years

(b) The product of last year’s profits and number of years

(c) The product of average profits of the given years and number of years

(d) None of the above - In case of inflationary environment:

(a) Cost of goods Sold as per FIFO will be higher than LIFO

(b) Cost of Goods Sold as per LIFO will be higher than FIFO

(c) Closing inventory as per LIFO will be higher than FIFO

(d) None of the above - The underlying accounting principle necessitating amortization of intangible Assets is / are:

(a) Cost concept

(b) Realization concept

(c) Matching concept

(d) Both (B) and (C) - The management decided that depreciation should be charged at 20% on written down basis on the closing balance of each year. Accounting is calendar year. On 1.7.2014 new machine was purchased at a cost of Rs. 50,000. What is the balance is machinery account as on 31.12.2015?

(a) Rs. 36,000

(b) Rs. 32,000

(c) Rs. 18,000

(d) Rs. 40,000 - The following is a non-current account:

(a) Inventory

(b) Plant and machinery

(c) Debtors

(d) Account Receivable

2015 (12 Questions)

- Which of the following elements represents an economic resource?

(a) Asset

(b) Liability

(c) Owner’s equity

(d) Retained earnings - Which of the following is most likely not any objective of financial statements?

(a) To provide information about the performance of an entity

(b) To provide information about the financial position of an entity

(c) To provide information about the users of an entity’s financial statements

(d) To provide information about cash flows - The assumption that an entity will continue to operate for the foreseeable future is called:

(a) Accrual basis

(b) Comparability

(c) Going concern

(d) Consistency - The assumption that the effects of transactions and other events are recognized when they occur, not when the cash flows occur, is called:

(a) Relevance

(b) Accrual basis

(c) Going concern

(d) Cash basis - A company had the following income statement information

Revenue Rs. 40,00,000

Cost of goods sold Rs. 30,00,000

Other operating expenses Rs. 5,00,000

Interest expense Rs. 1,00,000

Tax expense Rs. 1,20,000

The company’s gross profit is equal to :

(a) Rs. 2,80,000

(b) Rs. 5,00,000

(c) Rs. 10,00,000

(d) Rs. 15,00,000 - Money receiving from customers for product to be delivered in the future is recorded as:

(a) Revenue and an asset

(b) An assets and a liability

(c) Revenue and a liability

(d) Neither revenue nor liability A company uses the FIFO method and B company uses the LIFO method. Compared to the cost of replacing the inventory, during periods of rising prices, the cost of sales reported by :

(a) A company is too how

(b) B company is too low

(c) B company is too high

(d) A company is too high- Intangible assets with finite useful lives mostly differ from intangible lives with respect is accounting:

(a) Revaluation

(b) Impairment

(c) Amortisation

(d) Valuation - Why do accountants record transactions in the journal

(a) To ensure that all transactions are posted

(b) To ensure that total debits equal total credits

(c) To have a chronological record of all transactions

(d) To help prepare the financial statements - Under the revenue principle, revenue is recorded:

(a) At the earliest acceptable time

(b) At the latest acceptable time

(c) After it has been earned, but not before

(d) At the end of the accounting period - A capital reserve in built out of:

(a) Recurring profits

(b) Non-recurring profits

(c) Revenue

(d) Reserve fund - Once an accounting policy is adopted by a company, it:

(a) Must never be changed

(b) Must be changed on an annual basis

(c) Can be changed if another policy is more appropriate

(d) Can only be changed with the government’s approval

2014 (15 Questions)

- If the provision for bad debts account has a debit balance of Rs. 84 and provision is Rs. 462, the charge against the profit and loss account is:

(a) Rs. 546

(b) Rs. 462

(c) Rs. 378

(d) Rs. 84 - The items, closing inventory, is shown in balance sheet under:

(a) Fixed assets

(b) Current assets

(c) Current liabilities

(d) Miscellaneous expenditure - Which of the following is an important reason for studying accounting?

(a) The information provided by accounting is useful is making many economic decisions

(b) Accounting plays an important role in society

(c) The study of accounting could lead to a challenging career

(d) The study of the above are important reasons - Economic events that affect the financial position of a business are called:

(a) Separate entities

(b) Business transactions

(c) Money measures

(d) Financial actions - Which of the following types of accountants should be completely independent of the firm or organization whose financial data is being examined?

(a) Controller

(b) Chartered accountant

(c) Internal auditor

(d) Firm’s budget director - The immediate recognition of loss is supported by the underlying principle of:

(a) Matching

(b) Consistency

(c) Judgement

(d) Conservation - Generally Accepted Accounting principles:

(a) Define accounting practice at a time

(b) Are similar in nature to the principles of chemistry or physics

(c) Are rarely changed

(d) Are not affected by changes in the way business operates - The valuation of a promise to receive cash in the future at present value on the financial statement of a business entity is valid by virtue of which accounting postulate or principle.

(a) Entity

(b) Materiality

(c) Matching

(d) Going concern - A debit may signify

(a) An increase in an asset account

(b) A decrease in an asset account

(c) An increase in a liability account

(d) An increase in the capital account - Which of the following is not true of a trial balance?

(a) It proves that the total debts equals total credit if it balances

(b) If facilities preparation of financial statements

(c) It proves that no errors have been made in recording transactions, if it balances

(d) It will not detect an error where the accounts debited in recording a particular transaction - Deciding whether an expenditure for a desk is properly recorded as store equipment or office equipment is an example of:

(a) Recognition problem

(b) Valuation problem

(c) Classification problem

(d) Communication problem - As generally applied to accounting, what is depreciation?

(a) It is a process of asset valuation for balance sheet purposes.

(b) It applies only to long lived intangible assets

(c) It is used to indicate a decline in market value of long lived assets

(d) It is an accounting process which allocates long lived assets cost to accounting periods - The initial cost of a plant asset is equal to the asset’s implied cash price and:

(a) Interest paid on debt incurred to finance the asset’s purchase

(b) Market value of any non-cash asset given up to acquire the plant asset

(c) Reasonable and necessary cost incurred to prepare the asset for use.

(d) Asset’s estimated salvage value - If a unit of inventory has declined in value in an original cost, but the market value exceeds net reasonable value, the amount to be used for purpose of inventory valuation is:

(a) Net realisable value

(b) Original cost

(c) Market value

(d) Net realisable value less a normal profit margin - An inventory pricing procedure in which the oldest cost incurred rarely have an effect on the ending inventory valuation is:

(a) FIFO

(b) LIFO

(c) Weighted average

(d) Simple average

2013 (16 Questions)

- Which inventory pricing method reflects the most recently incurred purchase costs in the ending inventory?

(a) FIFO

(b) LIFO

(c) Simple Average

(d) Weighted Average - Lower of cost of market rule is an example of which concept?

(a) Consistency

(b) Conservation

(c) Realization

(d) Matching - Indiana companies are required to maintain their accounts on:

(a) Cash basis

(b) Accrual basis

(c) Accrual basis and double entry system

(d) Double entry system - Which of the following does not describe accounting?

(a) Language of business

(b) Is an end rather than a means to an end

(c) Useful for decision-making

(d) Used by business, government, non-profit organization and individuals - Sale of goods has

(a) Only revenue effect

(b) Only expense effect

(c) Both A and B

(d) None of the above - As-6 is related to:

(a) Valuation of inventories

(b) Accounting for construction contracts

(c) Cash flow statement

(d) Depreciation accounting - Which of the following is an important reason for studying accounting?

(a) The information provided by accounting is useful in making economic decisions

(b) Accounting plays an important role in society

(c) The study of accounting could lead to a challenging career

(d) All of the above are important reasons - Which of the following groups uses accounting information for planning a company’s profitability?

(a) Investors

(b) Creditors

(c) Management

(d) Regulatory - The payment of liability will:

(a) Increase both assets and liabilities

(b) Increase assets and decrease liabilities

(c) Decrease assets and increase liabilities

(d) Decrease assets and decrease liabilities - The accounting principle of matching is best demonstrated by:

(a) Not recognizing any expense unless some revenue is realized

(b) Associating effort (cost) with accomplishment (revenue)

(c) Recognizing prepaid rent received as revenue

(d) Establishing a reserve for possible future market decline in inventory account - Which of the following cost items would be matched with current revenue on a basis other than association of cause and effect?

(a) Goodwill

(b) Sales commission

(c) Cost of goods sold

(d) Purchases on credit - The valuation of a promise to receive cash in the future at present value on the financial statements of a business entity is valid by virtue of which accounting postulate or principle?

(a) Entity

(b) Materiality

(c) Matching

(d) Going concern - Payment for a two year insurance policy require a debit to:

(a) Prepaid Insurance

(b) Insurance Expense

(c) Cash

(d) Accounts payable - Which of the following is not true of a trial balance?

(a) It proves that the total debits equal total credits if it balances

(b) It facilitates preparation of financial statements

(c) It proves that no error have been made in recording transactions, if it balances

(d) It will not detect any error where the accounts debited and credited are reversed in recording a particular transaction - As generally applied to accounting, what is depreciation?

(a) It is a process of asset valuation for balance sheet purposes

(b) It applies only to long lived intangible assets

(c) It is used to indicate a decline in market value of long lived asset

(d) It is accounting process which allocates long lived assets cost to accounting periods - Which of the following reasons provides the best theoretical support for accelerated depreciation?

(a) Assets are more efficient in early year and initially generate more revenue

(b) Expenses should be allocated in a manner that smoothens earnings result

(c) Repairs and maintenance costs will probability increase in later period so depreciation should be decline

(d) Accelerated depreciation provides easier replacement because of the time value of money

2012 (16 Questions)

- When valuing inventory at lower of cost or market, what is the meaning of the term market?

(a) Net realizable value

(b) Net realizable value less a normal profit margin

(c) Current replacement cost

(d) Discounted present value - Which method of inventory pricing best approximates specific identification of the actual flow of cost and units in most situations?

(a) Average cost

(b) LIFO

(c) FIFO

(d) Specific identification - As generally applied to accounting, what is depreciation?

(a) It is a process of asset valuation for balance sheet purposes

(b) It appear only to long lived intangible assets

(c) It is used to indicate a decline in market value of long lived asset

(d) It is an accounting process which allocates long lived asset cost to accounting periods - Which of the following reasons provides the best theoretical support for accelerated depreciation?

(a) Assets are more efficient in early year and initially generates more revenue

(b) Expenses should be allocated in a manner that smooth earning result

(c) Repairs and maintenance costs will probably increase in later periods so depreciation should decline

(d) Accelerated depreciation provides easier replacement because of the time value of money - Provision for bad debts is made to:

(a) Prevent bad debts arising

(b) Obtain a true debtor’s figure for the balance sheet

(c) Even out actual bad debts incurring

(d) Encourage prompt payment of debts by debtors - The accounting principle of matching is best demonstrated by:

(a) Not recognizing any expenses unless some revenue is realized

(b) Associating effort (cost) with accomplishment (revenue)

(c) Recognizing prepaid rent received as revenue

(d) Establishing a reserve for possible future market decline in inventory account - Generally accepted accounting principles:

(a) Define accounting practice at a point in time

(b) Are similar in nature to the principles of chemistry or physics?

(c) Are rarely changed?

(d) Are not affected by changes in the way business operates? - The payment of an account payable (or any other liability) will:

(a) Increase one asset and decrease another asset

(b) Decrease an asset and decrease owner’s equity

(c) Decrease an asset and decrease a liability

(d) Increase an asset and increase a liability - Which account causes the main difference between a merchandiser’s adjusting and closing process and that of a service business?

(a) Advertising expenses

(b) Interest revenue

(c) Inventory

(d) Accounts receivable - The purpose of an accounting system includes all of the following except:

(a) Interpret and record and effects and business transactions

(b) Classify the effects of transactions to facilitate the preparation of reports

(c) Summarize and communicate information to decision makers

(d) Dictate the specific types of business transactions that the enterprise may engage in - Financial accounting information is characterized by all of the following except.

(a) It is historical in nature

(b) It sometimes results from inexact and approximate measures

(c) It is factual, so it does not require judgment to prepare

(d) It is enhanced by management’s explanation. - Which of the following financial statements is generally prepared first?

(a) Income statement

(b) Balance sheet

(c) Statement of retained earnings

(d) Statement of cash flows - Brand value for a business is:

(a) Capital

(b) Asset

(c) Profit

(d) Liability - Joint venture account is a:

(a) Nominal account

(b) Real account

(c) Artificial personal account

(d) Representative personal account - Goods purchase from Mr. Ajay for Rs. 10,000 passed through the sales book. The rectification will result in:

(a) Increase in gross profit

(b) Decrease in gross profit

(c) No effect on gross profit

(d) Either A or B - Indian companies are required to maintain their accounts on:

(a) Cash basis

(b) Accrual basis

(c) Accrual basis and double entry system

(d) Double entry system

2011 (11 Questions)

- Which one of the following will lead to under-statement of profits?

(a) Creation of general reserve

(b) Treating revenue expenditure as capital expenditure

(c) Amortization of fictitious assets

(d) Treating capital expenditure as revenue expenditure - What is the correct sequence of the following steps required for the preparation of final accounts?

I. Preparation of Trial Balance

II. Balancing of accounts

III. Preparation of annual financial statements

IV. Making adjustment entries

(a) IV, II, I, III

(b) II, IV, III, I

(c) II, I, III, IV

(d) IV, II, III, I - A contingent liability is shown due to:

(a) Convention of full disclosure

(b) Convention of conservation

(c) Convention of materiality

(d) Dual aspect concept - Which of the following is not a fundamental accounting assumption according to Accounting Standard-1 ?

(a) Going concern

(b) Business entity

(c) Consistency

(d) Accrual - Which item of revenue of the following is covered by Accounting Standard-9?

(a) Revenue arising from construction contracts

(b) Revenue arising from hire purchase

(c) Revenue arising from Govt. grants

(d) Revenue arising from sale of goods and rendering of services - An asset is purchased for Rs. 1,00,000 on which depreciation is to be provided annually according to the straight line method. The useful life of the assets is 10 years and the scrap value is Rs. 20,000. The rate of depreciation is:

(a) 20%

(b) 18%

(c) 10%

(d) 8% - First-in-First out (FIFO) method of inventory valuation is advisable in case of:

(a) Rising prices

(b) Fallings prices

(c) Constant prices

(d) Fluctuating prices - The cash price of a music system was Rs. 5,000 and its Hire Purchase Price was Rs. 6,000. There was no down payment. The payment was to be made in four equal instalments of Rs. 1,500 each payable at the end of each year. The amount of interest included in the first instalment was:

(a) Rs. 250

(b) Rs. 400

(c) Rs. 300

(d) None of these - In the absence of any agreement to the contrary, the deficiency of an insolvent partner’s capital account (debit balance) must be borne by the other solvent partners in:

(a) Profit and loss sharing ratio

(b) Equal proportion

(c) Capital ratio which stood prior to dissolution

(d) Capital ratio which stood after the dissolution of the firm - Donation received by a not-for profit organization for a specific purpose is a:

(a) Liability

(b) Asset

(c) Capital receipt

(d) Revenue receipt - Financial Accounting is primarily concerned with:

(a) Recording of financial information relating to activities of business

(b) Providing financial information to assist the management in decision-making

(c) Reporting financial information for external users of accounting reports

(d) Interpretation of financial statements

2010 (24 Questions)

- The owner of a firm includes his personal medical expenses in the profit and loss account of the firm. Indicate the accounting principle that is violated:

(a) Cost Principle

(b) Conservation

(c) Disclosure

(d) Entity concept - The obligation of an enterprise other than owner’s fund are known as:

(a) Assets

(b) Liabilities

(c) Capital

(d) Miscellaneous Expenditure - Contingent liabilities are shown in footnote of balance sheet because of:

(a) Materially convention

(b) Disclosure principle

(c) Realization concept

(d) Dual Aspect - Which of the following does not follow dual aspect?

(a) Increase in one asset, decrease in other

(b) Increase in both assets and liability

(c) Decrease in one asset, decrease in other

(d) Increase in one asset and capital - IASB stands for:

(a) Indian Accounting Standard Board

(b) Indian Accounting Standard Bulletin

(c) International Accounting Standard Board

(d) International Accounting Standard Bulletin - Accounting Policies:

(a) Are prescribed by AS-I

(b) are laid down by law

(c) Change from firm to firm

(d) Are same for all firms - Goods worth Rs. 10,000 are withdrawn by the proprietor for his personnel use. The account to be credited is:

(a) Sales Account

(b) Drawings Account

(c) Purchases Account

(d) Expenses Account - The written down value of an asset after three years of depreciation on reducing balance method @ 10% p.a. is Rs. 36,450. What was its original value?

(a) Rs. 40,000

(b) Rs. 50,000

(c) Rs. 45,000

(d) Rs. 70,250 - Bonus given to employees is recorded in:

(a) Trading Account

(b) Profit and Loss Account

(c) Profit and Loss Appreciation Account

(d) Manufacturing Account - A firm purchased goods of Rs. 90,000 and spent Rs. 6,000 on freight towards it. At the end of the years the cost of goods still unsold was Rs. 12,000. Sales during the year was Rs. 1,20,000. What is the gross profit earned by the firm?

(a) Rs. 36,000

(b) Rs. 18,000

(c) Rs. 42,000

(d) Rs. 38,000 - Going concern concept is not followed:

(a) By Banking Companies

(b) By Cooperative Societies

(c) By Joint Venture Firms

(d) In Depreciation Accounting - Commission received in advance Account appearing in the trial balance is :

(a) Shown on the liability side of the Balance Sheet

(b) Shown on the Assets side of the Balance Sheet

(c) Shown on the debt side of the Profit and Loss Account

(d) Shown on the credit side of the Profit and Loss Account - Income tax paid by a sole proprietor is shown:

(a) On the debit side of profit and loss account

(b) On the debit side of trading account

(c) By way of deduction from capital account in Balance Sheet

(d) On liabilities side of Balance Sheet - Bank Overdraft Account is a:

(a) Personal Account

(b) Nominal Account

(c) Real Account plus personal account

(d) Personal Account - If profit is 20% on the cost price, then it is:

(a) 16.67% of sales price

(b) 20% of sales price

(c) 25% of sales price

(d) 27% of sales price - Under instalment system of sales and ownership is transferred on:

(a) Payment of cash down money

(b) Payment of last instalment

(c) Payment of 90% of total price

(d) Payment of 50% of the price - Receipts and payments Account record:

(a) Capital receipts and Capital payments only

(b) Revenue receipts and Revenue payment only

(c) Capital expenditure only

(d) All receipts and payments whether capital or revenue - Under Inflationary conditions LIFO will lead to:

(a) No change in sale

(b) Higher sale

(c) Lower profit

(d) Higher profit - A draws Rs. 1,000 per month on the last day of every month. If the rate of interest is 5% p.a. then the total interest on drawings would be:

(a) Rs. 325

(b) Rs. 275

(c) Rs. 300

(d) Rs. 350 - X and Y shares profits and losses in the ratio of 4 : 3. They admit Z in the firm with 3/7 share which he gets 2/7 from X and 1/7 from Y. The new profit sharing ratio will be :

(a) 7 : 3 : 3

(b) 2 : 2 : 3

(c) 5 : 2 : 3

(d) 2 : 3 : 3 - On realisation of assets after dissolution of the firm the first payment is made towards :

(a) Cost of dissolution

(b) Outside liabilities

(c) Partners’ loans

(d) Deficiency in the capital account of an insolvent partner - Recovery of Bad Debts is a:

(a) Revenue Receipt

(b) Capital Receipt

(c) Capital Expenditure

(d) Revenue Expenditure - When unsold stock is taken away by a co-ventures then:

(a) Joint Stock Account is debited

(b) Joint Venture Account is debited

(c) Joint Bank Account is debited

(d) Co-venturer’s Account is debited - Account sales in Consignment Accounting indicates:

(a) The net amount due from consignor to consignee by way of commission

(b) The net amount due from consignee to consignor

(c) Net sales affected by consignee

(d) None of the above

2009 (15 Questions)

- When material purchase prices fluctuate widely, the method of pricing issues of material to production that will smooth out the effect of fluctuations is:

(a) Simple average pricing method

(b) Weighted average pricing method

(c) FIFO method

(d) LIFO method - When applied to the balance sheet, the convention of conservation results in:

(a) Understatement of assets

(b) Understatement of liabilities and provision

(c) Overstatement of capital

(d) All of the above - The sale of a business asset on credit is recorded in:

(a) Sales journal

(b) General journal

(c) Cash receipt journal

(d) Special journal - Rent prepaid account is of the nature of:

(a) Real account

(b) Personal Account

(c) Nominal Account

(d) None of these - Wages paid on the erection of new machinery should be debited to:

(a) Wages Account

(b) Cash Account

(c) Machinery Account

(d) Overheads Account - Errors which affect one account can be:

(a) Errors of omission

(b) errors of principle

(c) Errors of posting

(d) (a) and (b) are these - When nothing charges are paid by the bank at the time of dishonour of the bill, the drawee credits?

(a) Bank Account

(b) Nothing Charges Account

(c) Cash Account

(d) None of these - The amount of depreciation goes on declining every year in:

(a) Depreciation Fund method

(b) Annuity method

(c) Written down value method

(d) Straight line method - The balance of cash book shows:

(a) Net income

(b) cash in hand

(c) Net expenditure

(d) Net investment - Specific donations appearing on the receipts side of the Receipts and Payments Account are to be carried to:

(a) Income and Expenditure Account as income

(b) Asset side of the Balance Sheet

(c) Liability side of the Balance Sheet

(d) None of the shows - While preparing accounts from incomplete records, the figure of credit sales is calculated by preparing:

(a) Total Creditors Account

(b) Total Debtors Account

(c) Closing Balance Sheet

(d) Opening Balance Sheet - Under the double account system, the Profit and Loss Account is called:

(a) Profit and Loss A/c

(b) Income and Expenditure A/c

(c) Income A/c

(d) Revenue A/c - The value of goodwill, according to the simple profit method is:

(a) The production of current year’s profit and number of years

(b) The product of last year’s profits and number of years

(c) The product of average profits of the given years and number of years

(d) None of the above - A and B share profits in the ratio of 2 : 1. C has been admitted with 1/4th share in profits. The new profit sharing ratio of the partners will be:

(a) 2 : 1 : 1

(b) 1 : 2 : 1

(c) 2 : 1 : 2

(d) None of these - With reference to Royalty Accounts, if the right to recoup the short workings has expired, they are transferred by the lessee to:

(a) Profit and Loss Account

(b) Landlord Account

(c) Royalty Account

(d) Balance Sheet

Answer Key

2020

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |||

| (b) | (c) | (b) | (c) | (b) | (a) | (b) |

2019

| 1 | 2 | 3 | 4 | ||||||

| (a) | (c) | (c) | (b) |

2018

| 1 | 2 | 3 | 4 | 5 | 6 | ||||

| (c) | (a) | (c) | (a) | (a) | (c) |

2017

| 1 | 2 | 3 | 4 | 5 | 6 | ||||

| (c) | (a) | (b) | (a) | (a) | (d) |

2016

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| (b) | (b) | (d) | (b) | (a) | (c) | (b) | (c) | (a) | (b) |

2015

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| (a) | (c) | (c) | (b) | (c) | (b) | (Deleted Question) | (c) | (c) | (c) |

| 11 | 12 | ||||||||

| (b) | (c) |

2014

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| (a) | (b) | (d) | (b) | (b) | (d) | (a) | (d) | (a) | (c) |

| 11 | 12 | 13 | 14 | 15 | |||||

| (c) | (d) | (c) | (a) | (a) |

2013

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| (a) | (b) | (c) | (b) | (c) | (d) | (d) | (c) | (d) | (b) |

| 11 | 12 | 13 | 14 | 15 | 16 | ||||

| (a) | (d) | (a) | (c) | (d) | (a) |

2012

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| (c) | (c) | (d) | (a) | (b) | (b) | (a) | (c) | (c) | (d) |

| 11 | 12 | 13 | 14 | 15 | 16 | ||||

| (c) | (a) | (b) | (a) | (b) | (c) |

2011

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| (d) | (c) | (a) | (b) | (d) | (d) | (b) | (b) | (c) | (c) |

| 11 | |||||||||

| (c) |

2010

1 (d) 2 (b) 3 (b) 4 (c) 5 (c) 6 (a) 7 (c) 8 (b) 9 (b) 10 (a) 11 (c) 12 (a) 13 (c) 14 (a) 15 (a) 16 (b) 17 (d) 18 (c) 19 (b) 20 (b) 21 (a) 22 (a) 23 (Out of Syllabus) 24 (Out of Syllabus)

2009

1 (a) 2 (a) 3 (b) 4 (b) 5 (c) 6 (c) 7 (d) 8 (c) 9 (b) 10 (c) 11 (b) 12 (a) 13 (c) 14 (a) 15 (Out of Syllabus)

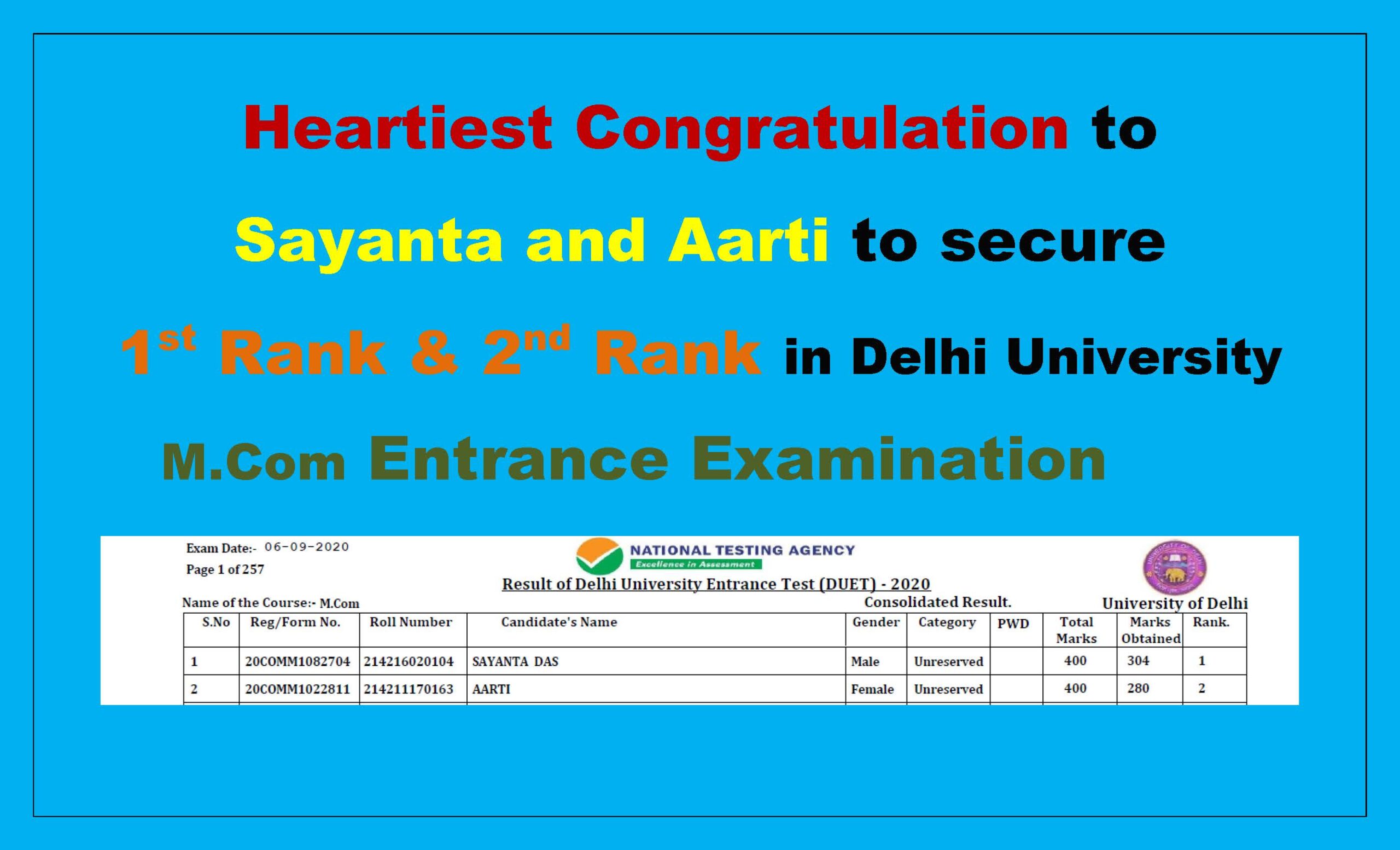

Most Relevant Book for M.Com Entrance Delhi University Examination

Total Pages 185

Link to Buy E – Book : Open

Link to Buy Printed Book : Open