- State which of the following statements is true

(a) Surcharge is levied when the total income of an Individual exceeds Rupees 2,50,000

(b) A patner is liable to pay tax on his share of income received from the firm

(c) An individual resident in India and non resident in India pay tax at the same rate.

(d) Education cess is imposed at total 3% on Income - Deducation in respect of section 80E for payment of interest on loan taken for higher education shall be allowed upto

(a) 20,000

(b) 25,000

(c) 30,000

(d) complete Amount - what is the maximum income tax rate for Hindu Undivided family ?

(a) 10%

(b) 20%

(c) 30%

(d) 40% - State which of the following statements is false

(a) Income from impartible estate is not included in the income of family

(b) Income from stridhan’ is not included in the income of family

(c) Income from investment in the name of member by the family is included in the income of family

(d) Incomes of members will be considerd while calculating tax liability of Hindu undivided Family - Interest and remuneration payable to partners is not deducatable if the firm

(a) is a limited liability partnership

(b) fulfil the conditions of section 184

(c) does not fullfil the conditions of section 184

(d) Not failure in fulfilling the provisions mentioned in section 144 - State the true statement from the following

(a) A partner is liable to pay tax on interest and remuneration received from firm

(b) The permissible rate of interest payable to partners is 15%

(c) A partner is liable to pay tax on his share of profit from firm

(d) partners can set off the losses of the firm from their income - what is maximum exemption limit of income for the firm in Assessment year 20162017 ?

(a) Zero

(b) 10,000

(c) 2,50,000

(d) 2,70,000 - Rate of minimum alternate tax excluding surcharge and education cess for other than companies is

(a) 10%

(b) 15%

(c) 18%

(d) 18.5% - Find the true Statement from the following

(a) due date for furnishing return of income for salaried person is June 30

(b) A charitable trust need not file return of income

(c) If return is filed after due date interest shall be charged @ 1% per month

(d) provisions of minimum Alternate tax do not apply to any assessee except companies - The last date for filing belated return for assessment year 201516 is

(a) July 31,2017

(b) September 30,2016

(c) March 31,2017

(d) July 31,2016 - A who is not engaged in business or profession computed the total income on self assessment Rupees 565000 .He paid advance tax Rupees 20720 and his tax deducted at Source was 15000 . He filed the return of his income on 12th October 2015 The amount of interst payable under section 234 A will be

(a) 3,400

(b) 102

(c) 3,520

(d) 3502 - Quoting Permanent Account Number is not compulsory if

(a) Time deposit exceeding 50000 in a bank

(b) Deposits exceeding Rs. 50000 in post office Saving Bank

(c) Payments to hotels restaurents of bills exceeding 25000 at any one time

(d) Sale or purchase of immovable property valued at less than 5,00,000 - Time limit for issue of notice U/s 148 is six years from the end of relevant assessment year if the escaped income is Rs …………… Or more .

(a) 50,000

(b) 1,00,000

(c) 10,00,000

(d) 15,00,000 - Advance tax is payable by citizen if tax payable after deducting tax at source is or more

(a) 5,000

(b) 10,000

(c) 15,000

(d) 20,000 - Sate the correct Statement out of the following Statements

(a) No Tax at source is deducted in respect of interest on Securities issued by domestic companies

(b) No tax at Source is deducted in case of winnings from lottery is in Kind

(c) On salaries tax is deducted at source according to provisions of section 192

(d) tax deducted at source is an advance tax - X Co has taken a show room on rent at the rate of 20,000 per month from Ram. During the previous year tax deduction by the company will be

(a) Zero

(b) 9,000

(c) 24,000

(d) 24,720 - The provisions relating to……………. Are given in section 206c.

(a) Tax Collection at Source

(b) Tax deduction at Source

(c) Advance Payment of Tax

(d) Filing return of income - The rate of interest per month shall be payable by Government in Case of delay in the grant of refund of income Tax

(a) 0.5%

(b) 1.0%

(c) 1.5%

(d) 2.0% - U/s 220 (2A) the interest may be reduced or waived by the Authority

(a) Inspector of Income tax

(b) Assessing officer

(c) Chief commissioner or commissioner

(d) Central Board of Direct Taxes - Which of the following is not a method of tax planning related to salary

(a) Tax free perquisites as part of Salary

(b) Tax free allowance as part of salary

(c) Encashment of earned leave on retirement

(d) Not commuting the pension - Which of the following is not a method of tax planning relating to capital gains

(a) Sales of an asset on becoming long term capital asset instead of short term capital asset

(b) Use of section 54,54B,54D,54F,54G or 54GA

(c) Loan taken for self occupied house property

(d) Subscribing right shares instead of sale of right - True statement in relation to ‘Tax avoidance is

(a) Tax avoidance is not illegal

(b) Provisions of low are flouted in tax avoidance

(c) penalty and prosecution is imposed on tax avoidance

(d) Tax Avoidance and Tax Evasion are synonymous - There is no tax evasion if

(a) Sale is recorded at lower amount

(b) Claiming bogus expenses and losses

(c) Charging personal expenses as business expenses

(d) Reduction in tax liability by transfer of property to major son - Find the ‘False’ statement from the following

(a) Income tax is a direct tax charged annually by the central government

(b) Previous year always starts from 1st April

(c) Capital receipt cannot be treated as income

(d) The income earned from illegal business is also taxable - In case of a women assessee (senior citizen) her agricaltural income of 20,000 shall be included in her total income when it is more than the following limit

(a) 1,35,000

(b) 1,50,000

(c) ‘2,35,000

(d) 3,00,000 - According to central excise Act Surrender of registration certificate becomes necessoary if

(a) Ceases to carry on the business operation mentioned

(b) Death of a partner

(c) Change in the constitution of ownership

(d) all of these - With regard to CENVAT credit in excise Duty Act, which

(a) No production NO CENVAT credit

(b) CENVAT credit is optional Scheme

(c) Inputs remain excise paid after CENVAT credit

(d) all of these - Find incorrect statement as per custom Act 1962

(a) Order for confiscation of goods may not be given unless a notice is issued to the owner giving resons in writing

(b) goods cannot be confiscated , if buyer is ignorant and in good faith

(c) Confiscated goods will not be sold if the owner pays penalty

(d) Any goods used for concealing goods against rules shall also be liable to confiscation - To determine “Assessable Value” as per custom Act 1962, landing and handling charges is taken as

(a) 20% of F.O.B.Price

(b) Actual expenses or 20% of F.O.B price, whichever is higher

(c) 1% of C.I.F Price

(d) Actual expense or 1% of C.I.F price whichever is less - To make the goods manufactured in India competitive in comparison to imported goods a duty of custom is charged as

(a) protective Duty

(b) safeguard Duty

(c) Countervailing Duty

(d) AntiDumping Duty - Who is not a dealer as per central sales tax act

(a) A farmer who runs his own shop for selling the grains grown on his own fields

(b) A steel manufacturing campany who has sold on old motor car and has earned some profit also

(c) A doctor who sells loose patented medicines drawn from sealed containers to other persons also besides own patients

(d) A person selling illegal goods - which of the following is treated as sale or purchase of goods during the course of interstate trade or commerce as per central sales tax Act

(a) Sending of goods to branch situated in other state

(b) sending of goods to another state for sale on consignment

(c) Movement of goods with in a sate during its sale or purchase through the territory of another state

(d) If the sale is effected by the trasfer of documents of title to goods during the movement of such goods from one state to another - The exemption not avilable in central sales tax Act is

(a) In relation to subsequent sales to registered dealers

(b) Sale of goods exempt generally in the state

(c) sale of goods declared U/S 14

(d) sale in the course of import or export - Who is not required to get registered U/s11 from the following as per Rajasthan Value Added Tax Act

(a) A manufacturer whose annual turnover does not exceed Rs. 2,00,000

(b) Registered Dealers under central sales tax Act

(c) Importer of goods from outside the state

(d) Dealer whose annual turnover exceeds Rs 10,00,000 - First time income tax introduced in india

(a) 1961

(b) 1886

(c) 1860

(d) 1857 - Mr. Anthony first time went to USA on 25th may 2015. He is ……….. For A.Y.201617

(a) Resident in India

(b) Not ordinarily resident in India

(c) NonResident in India

(d) (A) and (B) both - Maximum amount of Interest on House building Loan on Let out house U/s 24 is deductible

(a) 30,000

(b) 2,00,000

(c) 3,00,000

(d) what so ever amount of interest

- Rate of depreciation on water pollution control equipment is

(a) 40%

(b) 60%

(c) 15%

(d) 100% - Sales consideration of a long term asset is Rs. 1,00,000, Long term Capital gain Rs. 45,950 for assessment year 201617 Inflated index 8182= 100 Inflatd Index for p.y 201516 is 1081 . The cost of the asset is

(a) Rs. 4,000

(b) Rs. 5,000

(c) Rs. 6,000

(d) Rs. 7,000 - Standard Deduction available on Income from family pension is

(a) 20%. Of pension or Rs 15,000 whichever is less

(b) 25% of pension or Rs 15,000 whichever is less

(c) 33.33% of pension or rs 10,000 whichever is less

(d) 33.33% of pension or Rs 15,000 whichever is less - Maximum deduction U/s 80D for A.Y.201617 for an individual assessee is

(a) Rs. 15,000

(b) Rs.20,000

(c) Rs.25,000

(d) Rs. 40,000 - An Individual resident whose total income does not exceed Rs 5,00,000 then deduction of income tax U/s 87A for A.Y. 201617 is

(a) 100% of income tax or Rs. 5,000. whichever is less

(b) 100%.of income tax or Rs 3,000 whichever is less

(c) 100% of income tax or Rs 2000 whichever is less

(d) None of these - The total income and agricultural income of shri Ram are Rs 4,80,000 and Rs 30,000 respectively the income tax is

(a) Rs.23,690

(b) Rs.27,000

(c) Rs,24,000

(d) Rs.24,720 - Short term capital gain U/s 111A are taxable

(a) 10%

(b) 15%

(c) 20%

d) 30% - As the total income of any Individual assessee is more than one crore the surcharge is levied for A.Y. 201617

(a) 5%

(b) 8%

(c) 10%

(d) 12% - Can the remuneration given by a firm to its partners in case of loss be allowed u/s 40(b) ? It so to what extent ?

(a) yes Allowed upto Rs 90,000

(b) yes Allowed upto Rs. 1,50,000

(c) Yes Allowed upto Rs 60,000

(d) Yes Not Allowed - In which year was the central sales tax Act enacted?

(a) 1947

(b) 1956

(c) 1961

(d) 1965 - Which goods are exempted under Rajasthan Value Added Tax:

(a) Helmet

(b) Electricity Power

(c) Salt

(d) all of these - Service tax was introduced in India on the recommendation of

(a) Dr Man mohan Singh Committee

(b) Kelkar Committee

(c) Dr. Raja J Challaiah Committee

(d) Dr Yashwant sinha committee - Auditing means

(a) To prepare account books

(b) To examine accounting books

(c) To make adustment in accounts

(d) all of these - The primary objective of an auditor is

(a) Detection of errors

(b) certifying validity of information

(c) prevention of fraud

(d) all of these - Primary responsibility for the and adequacy of financial statement disclosures rest with

(a) Management

(b) Auditor

(c) Company Registrar

(d) Central Government - Balance sheet audit does not include

(a) vouching of income, expenses and accounts related to assets and liabilities

(b) Examination of adjusting and closing entries

(c) verification of assets and liabilities

(d) Routine check - In comparison to the independent auditor an internal auditor is more likely to be concerned with

(a) Cost Accounting System

(b) Internal Control System

(c) Legal Compliance

(d) Accounting system - Following is non financial audit

(a) operating audit

(b) process audit

(c) secretarial audit

(d) all of these - verification of assets is done to ascertain

(a) Existence of assets

(b) Owenership of assets

(c) possession of assets

(d) all of these - In Vouching The auditor verifies

(a) Only the right of transactions

(b) Only certification of transactions

(c) Right and certification of transaction,Both

(d) Only arithmetical accuracy of transactions - ‘Auditor is not insurer and does not give gaurantee for correctness of books’, this statement has been given in the case law

(a) CIT V/s G.M Dandekar

(b) London and General Bank

(c) Kingston cotton mills

(d) Mecesan & Robbins - A Qualified report given by the auditor indicates

(a) Auditior is satisfied with company’ s accounts

(b) Auditor is impressed with specialities of the company

(c) Both Auditior is satisfied with company’ s accounts and Auditor is impressed with specialities of the company

(d) Auditor is not satisfied with company’s accounts - Cost audit report is presented to

(a) Government

(b) Company

(c) (Government) and (Company) both

(d) Shareholders - Technique used in management audit

(a) Linear Programming

(b) Queue Theory

(c) Games Theory

(d) all of these - If a casual vacancy in the office of auditor arises by his resignation it should be filled by the company in a

(a) Board of director’s meeting

(b) Extraordinary General meeting

(c) General Meeting

(d) Annual General general Meeting - Who can be appointed as auditor of a company

(a) A person who has indebted for less than Rs1000 (to company)

(b) A Corporation

(c) An officer of the Company

(d) An employee of the Company - Every auditor appointed under companies Act 2013 must intimate to the registrar within ……… days of the receipt of appointment from the company

(a) 15

(b) 18

(c) 21

(d) 30 - In Case of directors fail to appoint first auditor(s) then he shall be appointed

(a) By government

(b) by company law board

(c) In statutory meeting

(d) In general meeting - Auditor submits report to

(a) Appointing authority

(b) Government

(c) Board of directors

(d) Shareholders - Audit of Banks is an example of

(a) Statutory Audit

(b) Balance sheet audit

(c) Concurrent audit

(d) None of these - Identify the correct statement

(a) Management audit is structured review of the system and procedurees on an organisation

(b) Management audit involves comparative study of actual performance against targeted performance

(c) Management audit is not compulsory

(d) all of these - Audit planning is covered under

(a) SA 200

(b) SA 250

(c) SA 300

(d) SA 400 - Audit working papers are the property of

(a) Client

(b) Auditor

(c) Income Tex Department

(d) The institute of chartered Accountants - The date on auditor’s report should not be

(a) The date of annual general meeting

(b) Later than the date on which the accounts are approved in Board’s meeting

(c) Earlier than the date on which the accounts are approved in Board’s meeting

(d) The date on which the accounts are approved in Board’s meeting - The retiring auditor doesn’t have a right to

(a) Make written representation

(b) get his representation circulated

(c) be heard at the meeting

(d) speak as a member of the company - Life Insurance Corporation of India holds 25% of subscribed capital of ABC Ltd The appointment of statutory auditor in ABC Ltd would be by

(a) Ordinary resolution

(b) special resolution

(c) Life Insurance corporation of India

(d) Comptroller and auditor general of India - Auditing is compulsory for

(a) Individuals

(b) Companies

(c) Partnership firms

(d) For all of these - “An audit programme is flexibly planned procedure of examination. ” This definition is given by

(a) Kohler

(b) De Paula

(c) Arthur W. Holmes

(d) Dicksee - Which of the following is not a type of Audit

(a) Management Audit

(b) Efficiency Audit

(c) Human Resource Audit

(d) Government Audit - Internal check System is of no use in which of following activity

(a) Standardization of costs

(b) Purchase of service Assets and material

(c) sales and sales return

(d) Cash transactions - The authenticity of financial statements is very essential and such authenticity of accounts can be assured with the help of an

(a) Independent Audit

(b) Internal Audit

(c) performance Audit

(d) None of these - Alternation of a figures after audit is a limitation of

(a) Continuous Audit

(b) Final Audit

(c) Interim Audit

(d) Financial audit - In India Balance sheet audit is synonymous to

(a) Continuous audit

(b) Detailed audit

(c) statutory audit

(d) Annual audit - internal check is a part of

(a) Internal Accounting

(b) Internal Control

(c) External Audit

(d) Internal Audit - vouching means:

(a) Examining the various assets

(b) Surprise checking of accounting records

(c) Inspection of receipts

(d) Examination of Vouchers to check authenticity of records - A continuous audit is specially needed for

(a) any manufacturing concern

(b) Banking companies

(c) Trading concerns

(d) Small concerns - Which of the following section of the companies Act 2013 contain provision as regards to qualifications of auditors

(a) Section 124

(b) Section 131

(c) Section 141

(d) Section 242 - The right of an auditor is:

(a) To take clarification

(b) to Conduct inspection

(c) to receive remuneration

(d) all of these - The reliability of audit evidence depends upon

(a) source

(b) nature

(c) Source and nature

(d) Timing - Auditing seeks _ _ _ _ _ _ _ evidence

(a) Conclusive

(b) Corroborative

(c) Both (Conclusive) and (Corroborative)

(d) Persuasive - Company’s auditor is appointed under which section of the companies Act 2013

(a) U/s138

(b) u/s139

(c) u/s224

(d) u/s238 - Who appoints internal auditor ?

(a) shareholders

(b) stock exchange

(c) mangement

(d) Government - The mangement can review proccess through

(a) external audit

(b) Internal Control

(c) Internal Audit

(d) Internal check - The Cost auditor has to judge whether the planned expenditure is designed to give :

(a) Appropriate results

(b) good results

(c) optimum results

(d) targeted results - Outstanding expenses should be verified with the help of

(a) Cash Book

(b) Income and Expenditure Account

(c) Journal proper

(d) Balance sheet - Performance Audit is also known as

(a) Detailed Audit

(b) Efficiency Audit

(c) Propriety Audit

(d) Management Audit - The auditor should be well acquainted with the rules of maintaining accounts and audit of the insurance companies of

(a) I.R.D Act 1949

(b) Banking Regulation Act 1949

(c) Indian Companies Act 2013

(d) None of these - Remuneration of Auditors is prescribed under section of Companies Act 2013

(a) 141

(b) 142

(c) 143

(d) 144 - In Environmental Audit IAIA stands for

(a) International Assembly of Impact Assessment

(b) Indian Assembly of Impact Assessment

(c) International Association of Impact Assessment

(d) Indian Association of Impact Assessment - Audit is conducted as per the provisions of law as

(a) Social Audit

(b) Continuous Audit

(c) Statutory Audit

(d) Government Audit - ……. Audit refers to the evaluation of company’s performance against planned goals in the area of social responsibilities

(a) Management Audit

(b) social Audit

(c) cost Audit

(d) Efficiency Audit - In EDP Audit , which of the following activities would most likely be performed by EDP department

(a) Distributing Output

(b) parity checks

(c) Authorising Transactions

(d) Correction of transnational errors - Statistics are formed by

(a) A single figure

(b) An absolute descriptive fact

(c) A group of homogeneous facts and figures

(d) A group of unrelated Facts - which of the following is not the source of secondary data

(a) Data published in news papers

(b) publications of central and state government

(c) Data obtained by a firm in a market survey conducted by it

(d) Data issued by world Bank

- The mean annual salary paid to all employees of a company was Rs 5000 . The mean annual salaries paid to male and female employee was Rs 5200 and Rs 4200 respectively determine the percentage of female employed

(a) 20

(b) 80

(c) 30

(d) 70 - Which of the following measures of dispersion is based on all the item values of the series

(a) Range

(b) Quartile Deviation

(c) Standard Deviation

4) None of these - Correct formula of skewness by Bowley is

(a) Q3Q1+ 2M

(b) Q3+Q12M

(c) #44abst_107_3.PNG#

(d) #44abst_107_4.PNG# - If the first quartile is 142 and the semi inter quartile range is 18,then assuming the distribution to be symmetrical , the value of median is

(a) 151

(b) 160

(c) 178

(d) None of these - Coefficient of correlation between X and Y is Zero, if both Variables

(a) Increase together

(b) decrease together

(c) Move in Opposite direction

(d) are paired randomly signifying absence of interrelationship between them - The correlation coefficient ‘r’is the ………….. Of the two regression coefficients byx and bxy

(a) Arithmatic Mean

(b) Geomatric Mean

(c) Harmonic Mean

(d) None of these - In How many ways can 7 member of a committee be seated if the minister and deputy minister always be with head

(a) 720

(b) 24

(c) 48

(d) 120 - In a game , cards are thoroughly shuffled and distributd equally among four players The probability that a specific player gets all the four kings is

(a) #44abst_112_1.PNG#

(b) #44abst_112_2.PNG#

(c) #44abst_112_3.PNG#

(d) #44abst_112_4.PNG# - In how many ways can a committee of 6 persons be formed from 7 Indians and 4 Japanees, if it is indispensable to include at least 2 Japanese ?

(a) 371

(b) 210

(c) 140

(d) 21

- From the following data estimate the most likely price of an article in Mumbai when price of that article in Kolkata is Rs 75 Mean price In KolKata(y)=Rs 65 Mean price in Mumbai=Rs 67, standard Deviation in Kolkata = 2.5 standard Deviation in Mumbai = 3.5 Correlation coefficient between two prices =+0.8 standard Deviation

(a) Rs.72.60

(b) Rs.78.20

(c) Rs. 60.50

(d) Rs. 77.30 - If both the reqression coefficents are negative then coefficient of correlation is

(a) Positive

(b) Negative

(c) Zero

(d) None of these - Which of the following is not a characteristics of Linear Programming

(a) Objective Function

(b) Constraints

(c) Negative Condition

(d) Non Negative Condition - Which of the following point is not included in formulating a linear programming problem ?

(a) Determination of Legislation formulated by state

(b) Identification of Decision Variables

(c) Determination of objective function

(d) Determination of constraints - Management decision problems are comprised of three main elements which of the following is not one of them

(a) probability

(b) Alternatives

(c) Constraints

(d) Objectives - Programme Evalutaion and Review Technique (PERT) is mainly useful for

(a) Small Projects

(b) Large and Complex Projects

(c) Research and Devlopment Projects

(d) Deterministic Activities - The part of Total time by which a particular activity can be delayed without affecting the preceding and succeeding activities is

(a) Independent Float

(b) Free Float

(c) Interfering Float

(d) Total Float - A distribution is a theoretical distribution that expresses the functional relation between each of the distinct value of the sample statistic and the corresponding probability

(a) Normal

(b) Binomial

(c) Sampling

(d) Poisson - If we don’t have any knowledge of population variance , then we have to estimate it from the

(a) Frequency

(b) Sample data

(c) Distribution

(d) Correlation - A test of hypothesis for which the region of rejection is wholly located at one end of the distribution of the test statstic is

(a) One tailed test

(b) Two tailed test

(c) Point estimate test

(d) Interval estimate test - Whole frequency table is needed for the calculation of

(a) Range

(b) Variance

(c) Both Range and Variance

(d) None of these - Which one is true

(a) A.M = Assumed Mean+ Arithmatic Mean of deviation of terms

(b) G.M = Assumed Mean+ Arithmatic Mean of deviations of terms

(c) Both (A.M= Assumed Mean+ Arithmatic Mean of deviation of terms) and (G.M= Assumed Mean+Arithmatic Mean of deviations of terms)

(d) None of these - If two unbiased dice one rolled together, what is the probability of getting no differnce of points

(a) 1/2

(b) 1/3

(c) 1/5

(d) 1/6 - The weekly average rainfall of a city including Sunday is 4 cm and excluding Sunday is 1.5 cm for the week Rainfall recorded on Sunday is

(a) 28cm

(b) 9cm

(c) 19cm

(d) 5.5cm - According to _ _ _ _ _”Statistics may be defined as the science of collection, presentation, analysis and interpretation of numerical data

(a) A.L.Bowley

(b) Selligman

(c) Lincon L.Chao

(d) Croxton & Cowden - Nationality of a student is

(a) An attribute

(b) A discrete Variable

(c) A Variable

(d) A Continuous Variable - “An average is an attempt to find out one single figure to describe the whole of figures . This definition is given by_ _ __ _ _ _ _

(a) Murry R.Spiegal

(b) Simpson and kafkav

(c) Croxton and Cowden

(d) Clark and Sekkade - The Mean of 15 Numbers is 15 if the two number 18 and 12 are excluded then the mean of the remaining numbers is :

(a) 12

(b) 25

(c) 10

(d) 15 - If Mode is 10 and Mean is 7 The value of Median

(a) 8.5

(b) 3

(c) 8

(d) 9 - If Mean is 10 and geometric mean is 8 find the Harmonic Mean

(a) 4.5

(b) 6.4

(c) 6.0

(d) 7.6 - In case of even number of observations which of the following is median?

(a) The weighted average of these two middle values

(b) Any of two middle most value

(c) The simple average of these two middle values

(d) None of these - C.V is Used:

(a) To make trend analysis

(b) To find coefficient of correlation

(c) To make comparative study of stability in two series

(d) To determine coefficient of regression - Rank correlation method was developed by

(a) Bowley

(b) Karl pearson

(c) C.E.spearman

(d) Kelly

- The regression line of Y on X is derived by

(a) The minimisation of vertical distance in the scatter diagram

(b) The minimisation of horizontal distance in the scatter diagram

(c) Both,The minimisation of vertical distance in the scatter diagram and The minimisation of horizontal distance in the scatter diagram

(d) The minimisation of vertical distance in the scatter diagram or The minimisation of horizontal distance in the scatter diagram -

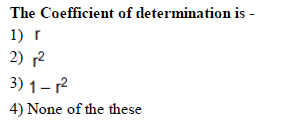

- The Coefficient of determination is-

- r

- r2

- 1-r2

- None of these

- The sum of two numbers obtained in a single throw of two dice is A Then the probability of A will be maximum when ‘A’

(a) 8

(b) 7

(c) 6

(d) 5 - The Probability of 53 sundays in non leap years

(a) .2857

(b) .1452

(c) .1429

(d) .1427 - which of the following criteria is not used for decision making under uncertainty

(a) Maximin

(b) Minimize expected Loss

(c) Minimax

(d) Maximax - The decision makers knowledge and experience may influence the decision making proceess when using the criterion of

(a) Maximax

(b) Realism

(c) Minimax regret

(d) Maximin - The Large sample test for testing p1=p2 for normal population is

(a) Ztest

(b) Ftest

(c) ttest

(d) None of these - Who formulate the linear programming

(a) G.Stigler

(b) L.Kantorovide and F.L. Hichcock

(c) G.B Dantzig

(d) Khachian - ……… may be defined as a method of determining an optimum programme inter dependent activities in view of available resources:

(a) Decision making

(b) Linear Programming

(c) Goal Programming

(d) None of these - Linear Programming model which involves funds allocation of limited investments is classified as

(a) fund investment models

(b) fund origin models

(c) Capital budgeting models

(d) Ordination Budgeting Models - Graphic method can be applied to solve a LPP when there are variables:

(a) one

(b) more than one

(c) two

(d) three - The citical activity has

(a) Maximum float

(b) Minimum float

(c) Zero Float

(d) None of theseAnswer Key

1 (c) 2 (d) 3 (c) 4 (d) 5 (c) 6 (a) 7 (a) 8 (d) 9 (c) 10 (c) 11 (b) 12 (d) 13 (b) 14 (b) 15 (c) 16 (c) 17 (a) 18 (a) 19 (c) 20 (d) 21 (c) 22 (*) 23 (d) 24 (b) 25 (d) 26 (a) 27 (d) 28 (b) 29 (c) 30 (c) 31 (a) 32 (d) 33 (c) 34 (a) 35 (c) 36 (c) 37 (d) 38 (d) 39 (d) 40 (b) 41 (d) 42 (c) 43 (c) 44 (d) 45 (b) 46 (d) 47 (b) 48 (b) 49 (d) 50 (c) 51 (b) 52 (*) 53 (a) 54 (d) 55 (b) 56 (d) 57 (d) 58 (c) 59 (b) 60 (d) 61 (a) 62 (d) 63 (*) 64 (a) 65 (*) 66 (d) 67 (d) 68 (a) 69 (d) 70 (c) 71 (b) 72 (c) 73 (d) 74 (b) 75 (b) 76 (c) 77 (c) 78 (a) 79 (a) 80 (a) 81 (d) 82 (b) 83 (d) 84 (b) 85 (c) 86 (d) 87 (c) 88 (c) 89 (b) 90 (c) 91 (c) 92 (c) 93 (c) 94 (b) 95 (d) 96 (b) 97 (c) 98 (c) 99 (b) 100 (a)101 (c) 102 (c) 103 (d) 104 (c) 105 (a) 106 (c) 107 (b) 108 (b) 109 (d) 110 (b) 111 (*) 112 (d) 113 (a) 114 (a) 115 (b) 116 (b) 117 (c) 118 (a) 119 (a) 120 (c)121 (a) 122 (c) 123 (b) 124 (a) 125 (b) 126 (a) 127 (d) 128 (c) 129 (d) 130 (a) 131 (d) 132 (d) 133 (c) 134 (b) 135 (c) 136 (c) 137 (c) 138 (a) 139 (a) 140 (b) 141 (b)142 (c) 143 (b) 144 (b) 145 (a) 146 (c) 147 (b) 148 (c) 149 (c) 150 (c)